Get the Edge: PARETO Principle in the Market

While learning the process of analysis and trading, I learnt that you need to be only just half a step ahead of the others for you to win this game. At that time, I did not understand how this could be so. After all, the market was full of smart people and if I had to win at this game then I really had to get good at it, perhaps very good. This meant doing a lot better than the others.

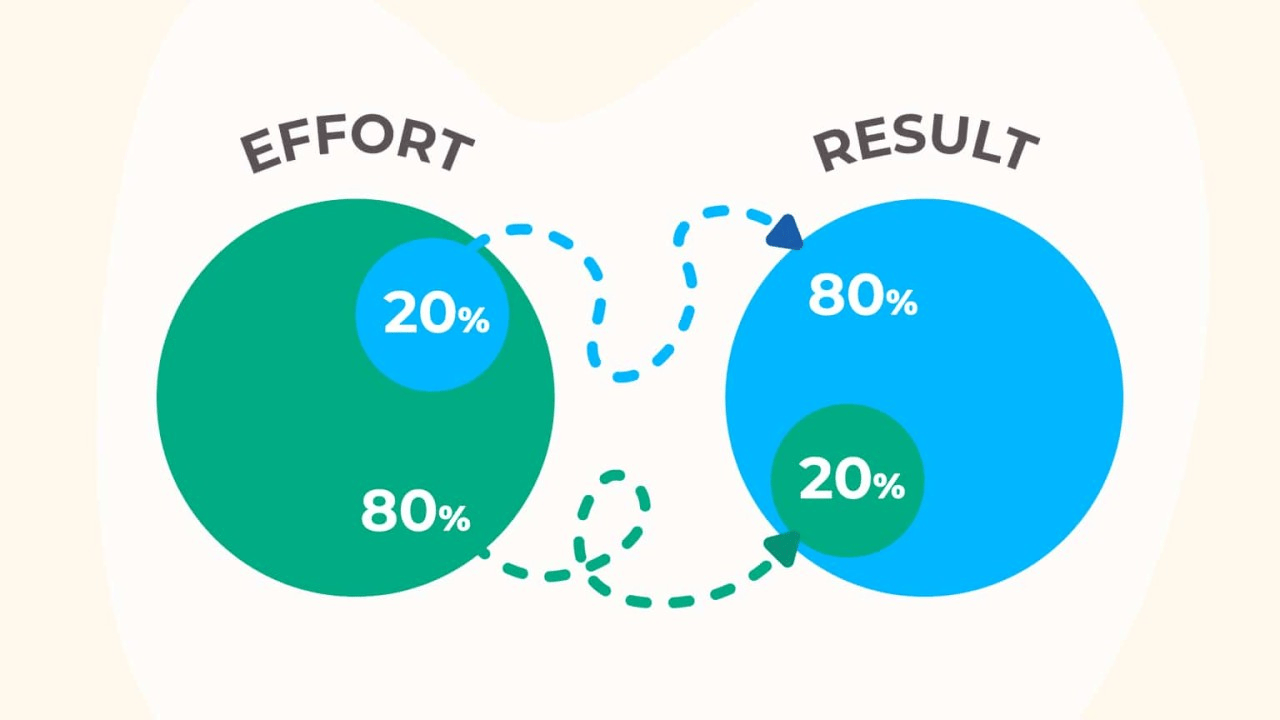

But the markets, like most things in life, also work on the Pareto principle- where 20% of the sample gets 80% of the rewards. In the markets, our gains come from 20% of our trades or investments. There is also one other aspect at work in the market- the Winner Take All (or perhaps, Most). It is like sports. You have to be only 1/100th of a second ahead of the next person to win the gold medal. Indeed, if you look at the finishers in a race at the Olympics, you will probably find that the difference between the top 5 or 7 people would be around 1/100th of a second. Still one person got the gold and many others, nothing. It is also seen over the years, that the same person or team keeps winning the gold year after year. It is not as though they are vastly superior to all the others around them- just a wee bit.

In the markets also the winners get most of the gains. And it is not as though they are so much better than you are. This winner takes all typically occur in situations that involve relative comparison, where your performance relative to those around you are the determining factor in your success. The market, being a collective, your relative performance counts a great deal, as your money really comes from the other participant in the market. Any decision that involves using a limited resource like time or money will naturally result in a winner-take-all situation. And, in the market time and money are extremely limited resources.

This is probably why those that have a lot of money often win in the market (assuming that they don’t botch their executions badly). It is also why those that are willing to give it more time manage to win more often. These two might have a lot to do with the popular concept of value investing- wherein you are pitching in a lot of money and waiting for a long time! This perhaps enables more people to win. But when it comes to trading, the two common things you find are- low capital, low ability to withstand unfavourable movements and small time frames. This is where a small advantage of a skill can possibly tilt the scales. And it tilts it to a dimension where the gains are disproportionate. In situations like these, being just a little bit better than the competition can lead to outsized rewards because the winner takes all. You only win by one percent or one second or one point, but you capture one hundred percent of the victory. The advantage of being a little bit better is not a little bit more reward, but the entire reward. The winner gets one and the rest get zero.

Scientists refer to this effect as “accumulative advantage.” What begins as a small advantage gets bigger over time? This is The Edge that one has to develop. It may be thru some technics, some learning, a lot of practice and dollops of common sense. As you develop and maintain the Edge, you begin to be favoured by the accumulative advantage and the gains, they just keep coming! To others you appear to be very lucky. But the real truth is that you have the Edge. And it is only a very minor one. The trick is that you keep working this Edge thru time. And after a point, it starts to work for you! What began as a small margin is starting to trend toward the 80/20 Rule? You start becoming the person who keeps winning 80% of the time and most others are in the 20% bracket. Winning one round improves your odds of winning the next. Each additional cycle further cements the status of those at the top.

Small differences in performance can lead to very unequal distributions when repeated over time. This is yet another reason why habits are so important. The people and organizations that can do the right things, more consistently are more likely to maintain a slight edge and accumulate disproportionate rewards over time.

You only need to be slightly better than your competition, but if you are able to maintain a slight edge today and tomorrow and the day after that, then you can repeat the process of winning by just a little bit over and over again. And thanks to Winner-Take-All Effects, each win delivers outsized rewards.

But to get that slight Edge you need to get trained, to educate yourself. Most traders and investors believe that they know everything that is needed to win in this market. Sadly, they end up in the 80% bucket of losers or also-rans. Those that take the effort to get trained and then, more importantly, put that training into practice are the ones that get the Edge and become the ones that get elevated to the 20%. To them, comes most of the money.

Leave a Reply

You must be logged in to post a comment.